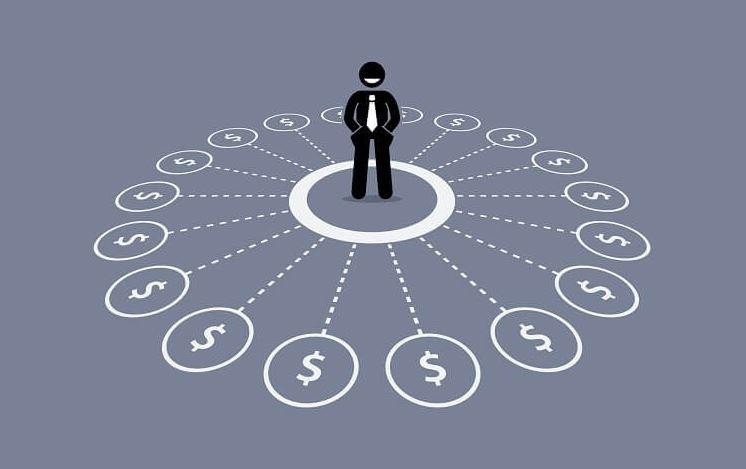

In today’s uncertain economic landscape, achieving financial stability often requires more than a single source of income. Cultivating multiple income streams has emerged as a necessary strategy for anyone looking to secure their financial future and build wealth over time. This guide explores the importance of diversifying your income and provides actionable tips for getting started.

By integrating various revenue paths, you not only safeguard against the unpredictability of one job or industry but also tap into the potential for exponential growth. Let’s explore how to broaden your financial portfolio through diverse income channels.

Understanding the Need for Multiple Income Streams

At its core, the concept of multiple income streams represents the strategic approach to generating revenue from various sources. This method stands in stark contrast to relying solely on a primary job, highlighting a proactive stance towards financial independence and security.

In the current economic framework, where job security can no longer be taken for granted, having several income sources offers a cushion against unforeseen financial challenges. Moreover, it opens up opportunities for greater financial growth and freedom.

Diversification is key not just in investing but in income generation as well. Engaging in numerous income-generating activities can help mitigate risks and provide a more stable financial footing.

From side hustles to investments, understanding and implementing diverse income strategies are crucial for anyone aiming to enhance their financial resilience and capability.

Strategies for Diversifying Your Income

Diversification can seem daunting at first, yet with the right approach, it’s quite attainable. Begin by evaluating your skills, interests, and resources to identify versatile opportunities that align with your most personal ambitions and existing capabilities.

Some of the most effective methods for diversifying your income include starting a side hustle, investing in the stock market or real estate, and leveraging the digital economy to create an online business. Additionally, developing passive income streams can significantly bolster your earning potential with minimal ongoing effort.

Exploring Ideas for side hustles can serve as a practical starting point for anyone looking to supplement their income without making substantial initial investments.

Investing for Passive Income

Passive income strategies allow you to earn money with minimal day-to-day involvement, offering a smart way to enhance your financial stability. From dividend stocks to rental properties, the options for creating passive income are diverse and plentiful.

Getting started with Investing for passive income requires some research and possibly some upfront investment, but the long-term benefits can be substantial. It’s about finding the right balance between risk and reward to suit your financial goals.

Real estate, in particular, has been a popular choice for generating passive income, though it requires a significant initial investment and ongoing management. Dividend stocks, on the other hand, offer a more accessible entry point for many investors.

Launching an Online Venture

The digital age has democratized the process of creating wealth, offering unprecedented opportunities to earn income online. From eCommerce stores to digital products and affiliate marketing, there are numerous avenues for establishing an effective online presence.

Building an online business requires a strategic approach, including market research, a solid business plan, and effective digital marketing strategies. However, the potential for scalable income is immense.

Moreover, online businesses often benefit from relatively low startup costs and the flexibility to operate from virtually anywhere in the world.

Enhancing Your Skills for Greater Opportunities

One common thread among successful income diversification strategies is the relentless pursuit of personal and professional development. Enhancing your skills not only opens up new opportunities for income generation but also positions you as a more valuable asset in any field.

Consider pursuing certifications, attending workshops, or even acquiring new knowledge through online courses. The more versatile and capable you are, the more opportunities you’ll have to generate income from different sources.

Practical Steps to Get Started

Starting your journey toward generating multiple income streams can begin with simple, practical steps. Priority should be given to assessing your current financial situation and setting clear, achievable goals for your diversified income plan.

Next, identify potential areas for income generation that resonate with your skills and interests. Develop a step-by-step plan for pursuing these opportunities, taking into account any initial investments of time or resources required.

Finally, stay committed to continual learning and adaptation. The landscape of income generation is always evolving, and staying informed is key to maximizing your potential for success.

In a world where financial security can seem elusive, empowering yourself with multiple income streams is not just smart; it’s essential. By strategically diversifying your income sources, you’re not only protecting against uncertainty but also paving the way for financial growth and independence. It’s a journey well worth embarking on, with the potential to transform not just your financial outlook, but your entire life.