Understanding the importance of having an emergency fund is crucial for financial stability and peace of mind. This foundational element in personal finance ensures you’re prepared for unexpected expenses or economic downturns without jeopardizing your financial health.

Through this post, we will explore the significance of an emergency reserve and how it can shield you and your family from unforeseen financial distress.

The Essence of an Emergency Fund

The foundation of robust financial planning lies in recognizing the importance of an emergency fund. It acts as a financial safety net that covers unexpected expenses such as medical bills, car repairs, or sudden job loss. Without it, individuals might resort to high-interest loans or credit card debt, leading to potential financial turmoil.

An adequately funded safety net enables you to address unplanned costs head-on, without derailing your long-term financial goals or daily living standards. This financial cushion provides not only economic security but also peace of mind during challenging times.

Financial experts typically recommend saving enough to cover three to six months’ worth of living expenses. However, the ideal size of this fund might vary depending on personal circumstances, job stability, and lifestyle.

Starting small and gradually building your reserve can make this task less daunting and more achievable.

Steps to Establish Your Emergency Fund

Commencing with clear, achievable steps is fundamental in creating a substantial emergency fund. Firstly, evaluate your monthly expenses to determine the target size of your fund. Then, establish a separate savings account specifically for this purpose to avoid the temptation of tapping into it for non-emergencies.

Automating your savings can significantly ease this process. By setting up a direct deposit from your paycheck into your emergency fund, you progressively build your safety net without having to think about it.

Cutting back on non-essential expenses and redirecting those funds into your savings can expedite the growth of your emergency reserve.

The Psychological Benefits

Beyond the financial security it provides, an emergency fund also offers substantial psychological benefits. Knowing you have a safety net can reduce stress and anxiety related to potential financial hardships.

This sense of security enables you to make decisions based on what’s truly best for you and your family, rather than out of immediate financial necessity. It fosters a more positive mindset towards money management, encouraging healthier financial habits.

Additionally, this financial cushion can empower you to take calculated risks, such as pursuing a new career path or starting a business, with the assurance that you have a fallback.

Financial peace is invaluable, and an emergency fund is a key contributor to achieving it.

The Impact on Financial Stability

The strength of an emergency fund extends beyond just coping with unexpected expenses; it directly contributes to your overall financial stability. By safeguarding against the need for debt in crises, it helps maintain your credit score and avoid the accumulation of high-interest debt.

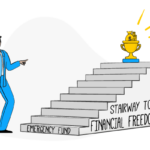

This solid financial footing allows you to pursue other goals, such as investing, homeownership, or further education, with confidence and security. An emergency fund is not merely a buffer but a stepping stone to realizing your long-term financial aspirations.

Moreover, in turbulent economic times, an emergency fund can be the difference between staying afloat and sinking into financial despair. It provides a buffer that can help you navigate through periods of economic uncertainty without drastic lifestyle changes.

The Role in Debt Prevention

One of the most significant roles of an emergency fund is its capacity to prevent debt. By having funds readily available for unexpected expenses, you’re less likely to rely on credit cards or loans that can accumulate interest and deepen financial strain.

This proactive approach to financial planning emphasizes control over your economic situation, rather than allowing it to control you. It’s a decisive step towards not just surviving, but thriving in the face of financial challenges.

Nurturing Your Emergency Fund

To ensure your emergency fund remains effective, regular reviews and adjustments are necessary. Life changes, such as a new family member, a move, or a change in employment, may necessitate recalculating the size of your fund to align with your current needs.

Moreover, as you reach your savings goal, don’t halt. Instead, consider setting new financial objectives to further solidify your financial security. An emergency fund is a living component of your financial plan, requiring ongoing attention and care.

In conclusion, the importance of an emergency fund cannot be overstated. It’s a fundamental aspect of financial planning that supports stability, freedom, and peace in face of uncertainty. Starting your emergency fund might seem challenging, but the security it brings to your financial life makes it a non-negotiable pillar of personal finance. Embrace the essence of an emergency fund and start building yours today to pave the way for a secure and prosperous future.