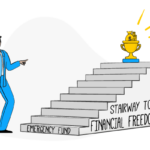

In an unpredictable world, having a financial safety net is more important than ever. Growing and maintaining an emergency fund can protect you and your family from unforeseen events. Here, we unravel invaluable strategies for nurturing this essential nest egg.

With a step-by-step guide, we’ll help you understand how to start, what amount is sufficient, and the best practices for preserving your fund’s health over time. Whether you’re just beginning or looking to improve your current savings, follow these insights for financial peace of mind.

Understanding the Importance of an Emergency Fund

An emergency fund acts as a financial buffer that can help you manage unforeseen expenses without having to rely on credit cards or high-interest loans. Whether it’s for sudden medical expenses, home repairs, or job loss, having this fund can be the difference between a minor setback and a financial disaster.

Start by setting a clear goal. Financial experts often recommend saving enough to cover three to six months’ worth of living expenses. This can provide enough cushion for most unexpected events. However, the exact amount can vary depending on your personal situation, job security, and monthly expenses.

Identifying your monthly expenses is crucial for determining your fund size. List all your essential expenses, including rent or mortgage, utilities, food, and any debt payments. This will give you a clear target to aim for.

Remember, the goal of this fund is accessibility. Hence, it should be kept in a liquid form, like a savings account or a money market fund, where it can be easily accessed without penalty.

Starting Your Fund

Growing your financial safety net starts with taking that first step. Begin by opening a dedicated savings account for your emergency fund. This separates your fund from everyday spending and reduces the temptation to dip into it.

Make your contributions automatic. Setting up an automatic transfer from your checking account to your emergency fund can make saving effortless. Even small, regular contributions can accumulate quickly.

Look for ways to cut back on non-essential expenses or increase your income through side jobs and use this extra money to boost your fund. Every little bit helps in building your safety net faster.

Preserving Your Fund

Once you’ve started building your emergency fund, maintaining its health becomes a priority. Review and adjust your contributions as your financial situation changes, such as after a pay raise or a decrease in expenses.

Resist the urge to use these funds for non-emergencies. Dipping into your emergency savings for everyday expenses or splurges can deplete your safety net when you need it most. It’s important to differentiate between wants and needs.

Routinely assess your fund’s adequacy. As you reach your initial goal, consider factors such as changes in your living situation or family size, which might necessitate an increase in your fund size.

Protect your fund’s purchasing power by reviewing the interest rate of your savings account annually. With inflation, it’s crucial to ensure that your fund’s growth at least keeps pace with it to maintain its real value over time.

Lastly, celebrate milestones. Reaching your saving goals, no matter how small, is an achievement worth celebrating. It encourages persistence and further growth of your emergency funds.

Making Your Fund Grow

Consider investing a portion of your emergency fund in low-risk investments once you have a comfortable amount saved. Although the primary goal is liquidity and safety, slightly higher yields from conservative investments like certificates of deposit (CDs) or Treasury bills can help counteract inflation.

Automate increases in your contributions. Linking your savings contribution to salary hikes or bonuses can help your fund grow without much effort.

Beware of maintaining too large an emergency fund. While it’s important to have a safety net, excessively large funds could lead to lost opportunities for higher returns in other investments. Striking a balance is key.

Stay informed about new savings options or accounts that may offer better returns or benefits. Financial institutions frequently update their products, and a better option for your emergency fund might become available.

Managing Setbacks

Should you need to use your emergency fund, prioritize replenishing it as soon as possible. Re-evaluate your budget and adjust your savings plan accordingly to rebuild the fund.

Don’t be discouraged by setbacks. Using your emergency fund is a testament to its importance and purpose. Focus on rebuilding it while learning from the experience to better prepare for future needs.

Keep your fund’s objective in mind, and resist the temptation to redirect your contributions to other financial goals until your emergency fund is fully replenished.

Setbacks are an opportunity to reassess your financial planning and ensure your strategies align with your current needs and goals.

Final Thoughts

Growing and maintaining an emergency fund is a cornerstone of sound financial planning. It provides peace of mind knowing you have a buffer against life’s uncertainties. By starting small, making saving automatic, and regularly assessing your financial goals and strategies, you can build and preserve a robust financial safety net.

Remember, the key to a healthy emergency fund is not just in its size, but in its readiness and accessibility during times of need. With careful planning and discipline, you can ensure that your fund is well-prepared to support you and your loved ones in any situation.

With these strategies in mind, focus on cultivating your emergency fund with the same care and attention you would give to any critical project. It’s not just about growing your savings; it’s about securing your financial future and providing a cushion that allows you to handle life’s challenges with confidence.