Posted inAI

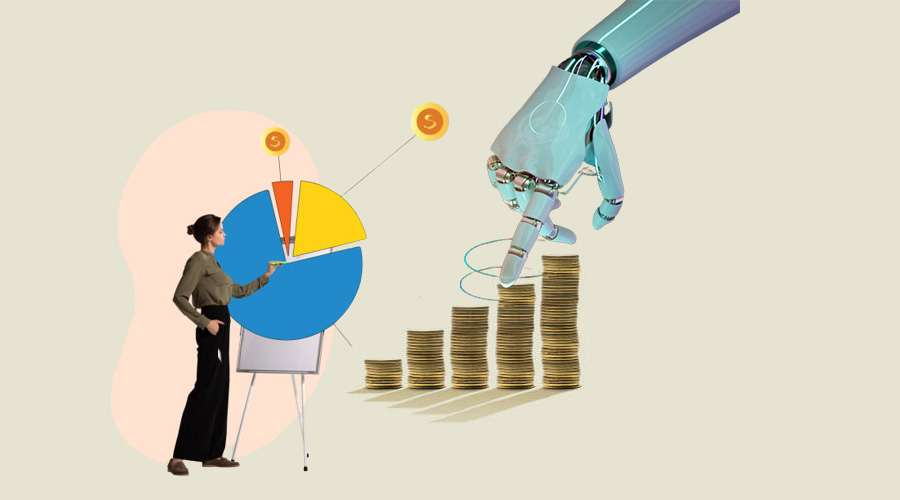

The role of AI in personal finance

The integration of AI in finance has revolutionized personal financial management, offering new opportunities and challenges. With AI technologies, individuals can now experience more efficient and personalized financial services. This transformation enables smarter decision-making and enhanced security but also presents privacy and reliance risks. Understanding the impact of AI in finance is crucial for navigating this evolving landscape, ensuring that individuals can harness the benefits while mitigating potential downsides.