Posted inFamily financial control

Financial planning for families

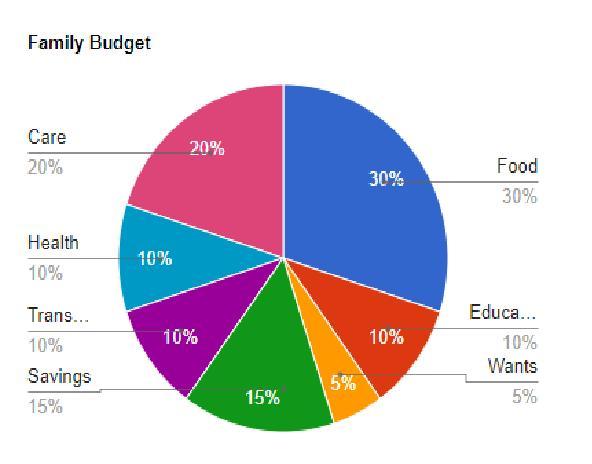

Understanding effective financial planning for families is paramount in securing their future and preparing for unexpected events. This comprehensive guide delves into strategies and tools essential for crafting a robust financial plan. It emphasizes the importance of budgeting, savings, investment, and insurance in safeguarding a family's economic well-being. Highlighting practical steps, the guide serves as a critical resource in establishing a strong financial foundation for families. Embracing these principles of financial planning ensures stability and prosperity, enabling families to navigate today's complex economic landscape with confidence.