Family budgeting is not just about reconciling bank statements at the end of the month but about securing a financial future for your loved ones.

This guide will break down the essentials of managing household finances effectively, ensuring every family member can contribute to and benefit from a well-structured budget.

Understanding the Basics of Family Budgeting

At its core, family budgeting involves tracking incomes, expenses, savings, and investments to ensure financial security and goals alignment. It requires cooperation from all family members to prioritize needs over wants and make long-term plans over immediate gratifications.

To commence, you need to calculate your total income from all sources. This includes salaries, bonuses, and any other forms of income like investments or side gigs.

Next, outline your fixed and variable expenses. Fixed expenses remain constant, such as rent or mortgage payments, while variable expenses like groceries and entertainment can fluctuate.

Finally, setting realistic goals for savings and investments is crucial for emergencies, retirement, and other long-term objectives such as education funds.

Tools and Apps to Ease the Process

In today’s digital age, numerous apps and online tools can simplify the process of family budgeting. Tools like Mint, YNAB (You Need A Budget), and PocketGuard help track spending, set budgeting goals, and even offer personalized financial advice.

Choosing the right tool depends on your family’s specific needs, whether it’s tracking daily expenses or investing for the future.

Integrating these tools into your daily financial planning can automate much of the process, allowing more time for family and less for spreadsheets.

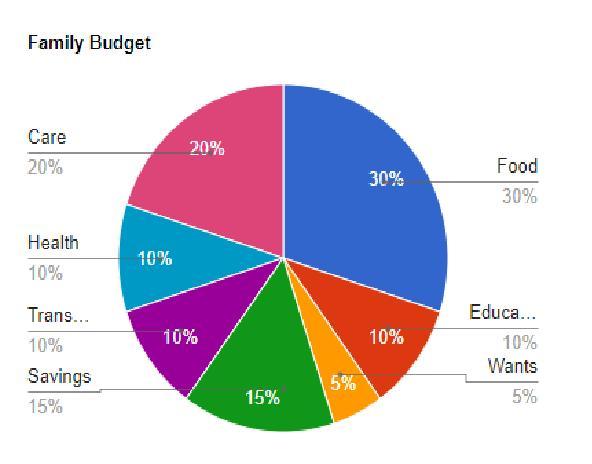

Allocating Funds Wisely

Rational allocation of resources is pivotal. It involves not just splitting expenses but also inculcating a sense of financial responsibility in each family member.

Start by categorizing expenses into essentials, non-essentials, and luxuries. Determine a fixed percentage of income that goes into savings and stick to it religiously.

Emphasize the importance of an emergency fund. Life is unpredictable, and having a financial cushion can help you navigate through unforeseen circumstances without derailing your budget.

Involve children in budget discussions to impart financial literacy from an early age.

Consider future expenses and adjust your monthly budget accordingly. This proactive approach helps in managing large expenses without financial strain.

Reducing Costs without Compromising Quality of Life

Identify areas where you can cut costs without significantly impacting your family’s lifestyle. This could mean switching to more affordable brands, minimizing dine-outs, or opting for local vacations.

Utilize coupons, discounts, and loyalty programs to save on everyday purchases. Planning meals and reducing food waste can also significantly lower grocery bills.

Consider energy-efficient appliances and minor home improvements to reduce utility bills.

Engage in affordable or free family activities like hiking, community events, or at-home movie nights.

Maintain open communication about finances to make informed decisions that align with your budgeting goals.

Investing in Your Family’s Future

Allocating a portion of your budget towards investments can secure your family’s financial future. Research and consult with a financial advisor to choose the right investment vehicles based on your goals, risk tolerance, and time horizon.

Consider retirement accounts, education savings plans, and other long-term investment options that offer growth potential and tax advantages.

Regularly review and adjust your investment strategies to reflect changes in your financial situation and goals.

Investing in insurance policies is also vital to protect your family against unforeseen events.

A Collaborative Effort

Involve every member of the family in the budgeting process. This fosters a sense of ownership and responsibility towards financial goals.

Regular family meetings to review the budget, celebrate milestones, and discuss adjustments are beneficial.

Encourage open communication about money matters to dispel any financial anxieties and ensure collective decision-making.

Teaching children about budgeting and saving from a young age prepares them for financial independence.

Review and Adapt

Your family’s needs and financial situation will evolve, so should your budget. Review your budgeting plan regularly to adapt to changes such as income fluctuations, additional family members, or shifting goals.

Continuously look for ways to optimize your spending and saving strategies.

Address any budgeting challenges as a family and make necessary adjustments to stay on track.

Remember, a successful family budget is flexible, realistic, and inclusive, allowing for both planning for the future and enjoying the present.

In conclusion, effective family budgeting is a continuous process of planning, monitoring, and adjusting your financial habits to ensure long-term stability and goal attainment. By involving all family members in the process, utilizing the right tools, and maintaining open communication, you can create a robust financial plan that supports your family’s needs and dreams. Let the journey of family budgeting lead you towards financial peace and prosperity.