Mastering your financial realm includes understanding effective debt management strategies. In this rapidly fluctuating economy, staying informed about the best ways to manage your indebtedness can provide not only financial relief but also a pathway to financial freedom.

This guide offers comprehensive insight into managing your financial obligations wisely, focusing on actionable and practical steps towards a debt-free future.

Debt Management Strategies: An Overview

Effective debt management strategies are crucial in navigating the complexities of various financial obligations. It entails a thorough understanding of your debts, formulating a solid plan, and taking proactive steps towards repayment.

Recognizing the types of debt you owe is the first step toward managing it effectively. For further insight, consider exploring Understanding different types of debt, which provides a detailed breakdown.

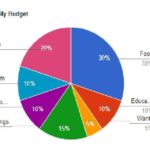

Following this, creating a budget that prioritizes debt repayment is essential. Tracking your income and expenses helps in identifying opportunities to reduce spending and allocate more towards your debt.

Another critical aspect is understanding the interest rates on your debts. Prioritizing high-interest debts can save you a significant amount in the long run.

Setting Realistic Goals

Long-term financial stability begins with setting realistic repayment goals. These should be achievable, taking into account your financial situation and income stability.

Establishing an emergency fund is also part of this strategy. It ensures that unexpected expenses do not derail your repayment plan.

Visualizing your progress and celebrating milestones can keep you motivated throughout the journey.

Creative Repayment Strategies

The debt snowball and avalanche methods are innovative approaches to debt repayment. The snowball method involves paying off smaller debts first, while the avalanche method focuses on debts with the highest interest rates.

Plans for paying off debt quickly outlines these methods and more, detailing how they can be applied effectively.

Consolidating your debts into a single payment can also simplify your repayment process and potentially reduce the interest rate.

Considering side hustles or additional income sources can accelerate your debt repayment efforts.

Annual bonuses or tax refunds provide an excellent opportunity to make extra payments on your debts.

Negotiating With Creditors

Believe it or not, negotiating with creditors can result in more favorable repayment terms. It requires a clear understanding of your financial situation and the ability to communicate your willingness to repay.

How to negotiate with creditors offers practical tips on approaching these negotiations effectively.

Seeking professional advice from debt management advisors or credit counseling services can provide additional strategies tailored to your situation.

Remember, maintaining open communication with your creditors can prevent the situation from worsening.

Debt settlement is another option, though it should be considered carefully due to potential impacts on your credit score.

Leveraging Technology

Modern technology offers numerous tools and apps designed to assist in debt management. These tools can help you track your debts, create a repayment plan, and monitor your progress.

Automating your debt payments ensures that you never miss a payment and stay on track with your repayment plan.

Financial planning software can offer insights into how different repayment strategies affect your overall financial health.

Engaging with online forums and communities can provide support, advice, and motivation from others who are on the same journey.

Understanding the Psychological Impact

Debt can weigh heavily on your mental health, leading to stress and anxiety. Acknowledging the psychological impact is crucial in finding a sustainable path to debt freedom.

Seeking support from friends, family, or professional counselors can make the process more manageable.

Maintaining a positive outlook and staying focused on your goals are keys to overcoming the challenges associated with indebtedness.

Self-education through books, podcasts, and seminars can empower you with knowledge and motivation.

Conclusion

Debt management strategies are essential tools in attaining financial freedom. By understanding your debts, setting realistic goals, exploring creative repayment strategies, negotiating with creditors, leveraging technology, and addressing the psychological aspects, you can navigate your way out of debt effectively. Remember, the journey to being debt-free is a marathon, not a sprint. Patience, persistence, and a positive mindset are your greatest allies.