Preparing for your child’s higher education is a journey that begins much before they start applying to colleges. With the rising costs of tuition, it becomes imperative to start setting aside funds early on. This blog post will explore comprehensive strategies for saving for college, providing you with a roadmap to secure your child’s academic future without compromising your financial well-being.

The key to accumulating a significant education fund lies in understanding the various saving vehicles available, knowing how to leverage them, and consistently contributing over time. Let’s dive into the best ways to ensure your child can pursue their dreams without financial barriers.

Understanding the Costs Involved

The first step in planning for your child’s university expenses is to understand the potential costs involved. It’s not just about tuition; it includes room and board, books, supplies, and other living expenses. Getting a comprehensive view of these expenses can help you set a realistic saving goal.

Researching the costs of institutions that your child might be interested in can give you a ballpark figure to aim for. Remember, the earlier you start saving, the more interest your investment can accrue.

Start Saving Early

Beginning your savings journey as early as possible gives your money the maximum amount of time to grow. Time is a crucial element of compounding interest, and even small contributions can grow significantly over 18 years or more.

Consider automatic contributions to a dedicated savings account for college to ensure consistent growth. Making saving a non-negotiable part of your budget can yield surprising results over time.

Choosing the Right Saving Vehicles

Not all saving strategies are created equal, especially when it comes to saving for college. Understanding the pros and cons of different vehicles such as 529 Plans, Coverdell Education Savings Accounts, and UGMA/UTMA accounts can significantly impact your saving efficacy.

For many, a 529 Plan might offer the most benefits, including tax advantages and high contribution limits. However, it’s crucial to research or consult a financial advisor to find the best fit for your financial situation.

Incorporate saving for college into your broader financial plan to ensure it complements other financial goals such as retirement saving.

Utilize Scholarships and Grants

While saving is crucial, reducing the need for savings through scholarships and grants can also be part of your strategy. Encourage your child to apply for scholarships and grants, which can significantly reduce the financial burden of college education.

Starting this search early and understanding the requirements for various scholarships can increase your chances of securing financial aid.

Involve Your Child in the Saving Process

Involving your child in the saving process can teach them valuable lessons about financial responsibility and the true cost of education. It can also motivate them to contribute from their own earnings or savings, whether from part-time jobs, allowances, or gifts.

Discussing the financial aspects of their future studies can help align your saving goals and encourage them to take academic and extracurricular activities seriously.

Consider a Part-Time Job or Internship for Your Child

Encouraging your child to take on a part-time job or internship can provide them with not only an opportunity to contribute to their college fund but also valuable life experience. This income can directly support education expenses, reducing the overall financial burden on the family.

Moreover, work experience can enhance their college applications, potentially opening doors to additional scholarship opportunities.

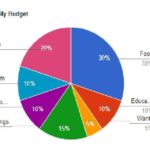

Budgeting and Cutting Costs

Revising your family budget to find areas where you can cut costs and reallocate funds towards the college saving account can accelerate your progress. Every little bit helps, and sacrificing small luxuries can add up to significant contributions over time.

Consider also that the choice of college, type of accommodation, and lifestyle during college years can greatly affect the total cost. Planning and making strategic decisions early can contribute to significant savings.

Saving for college is a multifaceted strategy that involves early planning, informed decision-making, and consistent action. By understanding the total cost of education, utilizing the right saving vehicles, seeking out scholarships, and involving your child in the process, you can build a substantial education fund. Remember, every step taken today can help ease the financial burden of higher education tomorrow, paving the way for your child’s success.