Posted inFinance

Mastering credit scores for better loans

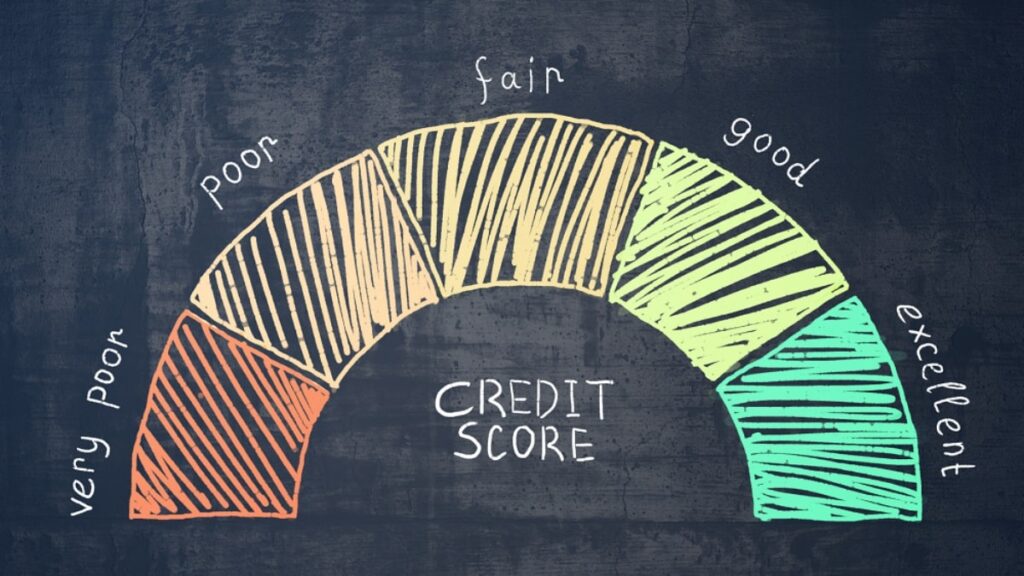

Mastering credit scores is key to securing lower interest rates and better loan options, ultimately saving money. This guide delves into understanding and improving your credit score, offering practical steps for financial health. By focusing on credit management, individuals can unlock favorable loan terms, making mastering credit scores an essential strategy for financial success.