Posted inInvestment

Key concepts in financial education

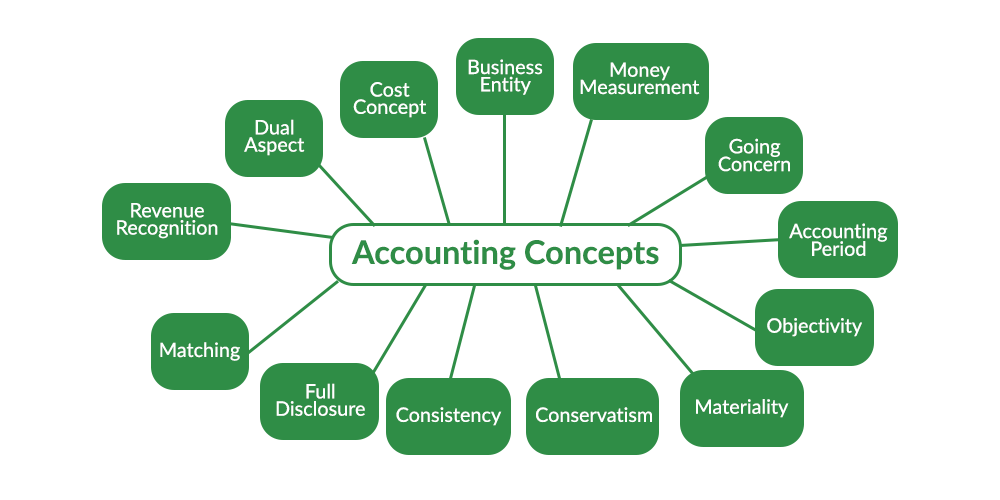

Understanding the essentials of financial education is vital for navigating modern economic challenges. This foundational knowledge enables individuals to make informed decisions, fostering financial security and independence. Financial education covers essential topics such as budgeting, investing, and saving, equipping individuals with the tools they need for a more secure financial future. By prioritizing financial literacy, people can significantly improve their life quality, demonstrating the importance of this education in achieving long-term economic success and stability.